property tax on leased car massachusetts

You have a 3 year lease on a car with an msrp of 20000 and a 50 residual. The property tax is collected by the tax collectors office in the countycity in which the vehicle is registered.

You Can Avoid Taxes On Your New Car Although It S Risky Business Feature Car And Driver

In all cases the tax assessor will bill.

. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The taxing collector dictates the tax amount owed and the timing of. The definition of sale includes any transfer of ownership or possession or both in return including the rental or leasing of tangible personal property.

For a leased vehicle you will have to pay massachusetts 625 sales tax on the lease price which would be applied to your monthly payment. The amount of tax you will owe will depend on. How is Excise Tax determined for the state of Massachusetts.

For a leased vehicle you will have to pay massachusetts 625 sales tax on the lease price which would be applied to your monthly payment. Excise tax is assessed from the time the vehicle is registered at the RMV. You will have to pay personal property taxes on any vehicle you do not register.

Property Tax On Leased Car In Ma PRFRTY. You can only drive so many miles each year in a leased car. For instance if your monthly payments reach 500 a month for three years and youre required to pay 7 percent sales tax on the vehicles entire value youll end up paying an extra 1260 in.

In the fifth and all succeeding years. Property Tax On Leased Car In Ma. This page describes the taxability of.

The state-wide tax rate is 025. The excise rate is 25 per 1000 of your vehicles value. According to a proposed law taxpayers would be required to collect sales and local tax on all long-term leases of motor vehicles and rental car owners would be required to pay a.

How is Excise Tax determined for the state of Massachusetts. Ask your honda dealer for information about the. 4 Dirty Little Secrets About the Personal Property Tax Massachusetts Leased Car Industry.

Ga Liens Forsyth Tax. The state-wide tax rate is 025. If you lease a car in the state of Massachusetts you are responsible for paying property tax on that car.

Excise tax is assessed from the time the vehicle is registered at the RMV.

2020 Residential Property Tax Rates For 344 Ma Communities Boston Ma Patch

Cis Motor Vehicle Excise Information

326 W Main St Hyannis Ma 02601 Loopnet

Sales Tax On Cars And Vehicles In Massachusetts

Nj Car Sales Tax Everything You Need To Know

How To Register A Leased Car In Another State State2state Movers

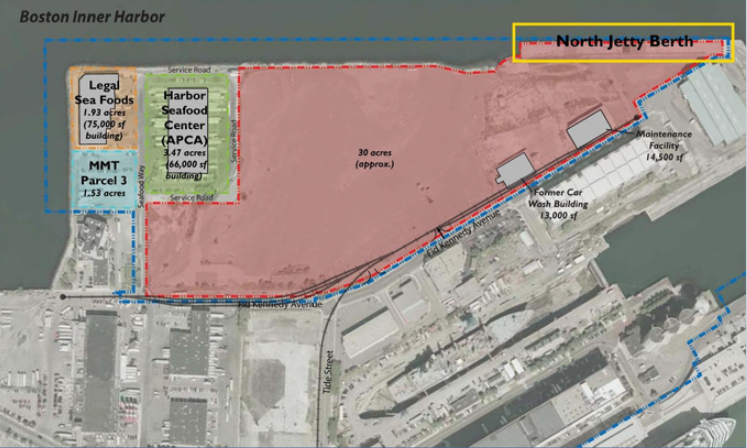

Massport Marine Terminal Land Lease Mass Gov

287 Turnpike Rd Westborough Ma 01581 Office For Sale Loopnet

Tesla Lease Guide Prices Estimated Payments Faqs And More Electrek

Leasing A Car And Moving To Another State What To Know And What To Do

Middlesex County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Massachusetts Landlord Tenant Law Avail

Private Party Used Car Sales Mass Gov

Used Cars In Boston Ma For Sale Enterprise Car Sales

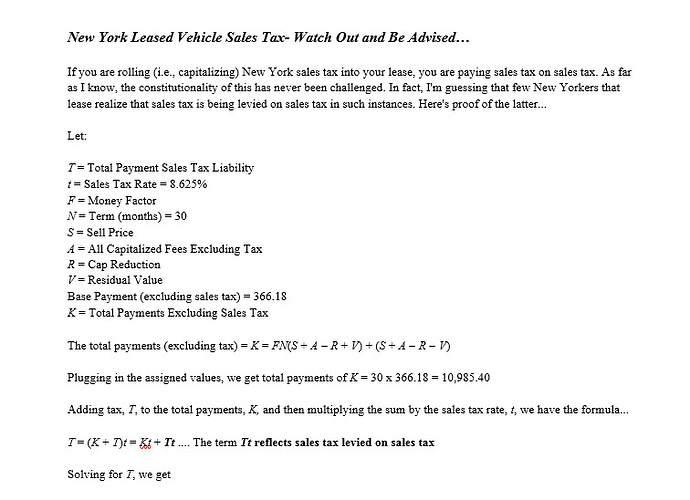

Sales Tax In Ny Off Ramp Forum Leasehackr

Two Identical Cars But Two Very Different Massachusetts Excise Tax Bills

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

Two Identical Cars But Two Very Different Massachusetts Excise Tax Bills